Your child’s education is one of the most important decisions you will ever make. However, finding the proper day care that suits you and your child can seem overwhelming, highly emotional and confusing.

You not only need to navigate the many day centres available and the curriculum they offer but also find out what financial support, tools, and information is available when you find the perfect place for your child’s early childhood education.

Finding the perfect daycare and navigating their fees is a barrier many parents face when applying for their child to start school. Luckily, help is at hand.

Eligible families in NSW can apply for a Child Care Subsidy (also known as CCS) from the Australian Government for all children under 13 years old to help with the cost of preschool child care.

We recommend you check eligibility and apply for your CCS as soon as you know when your child will be attending child care, as the whole process can take around four to six weeks. Before we get started advising you on your eligibility, we want to note a few things:

- To speed up the process, sign up for a MyGov Account.

All you have to do is go to MyGov Account and sign up. If you need help setting up your account, here’s how to create a MyGov account from the Australian Taxation Office. You can also get more information from the Centrelink online account help at Services Australia.

- We always recommend that you ensure that all your essential documents are stored in an easily accessible place to fill out any form or provide relevant information quickly and efficiently.

- Please note that a Child Care subsidy claim can be backdated up to 28 days. However, we strongly recommend that you start the process as soon as you decide when your child may start.

Taking these steps in mind, we hope our Child Care Subsidy guide is helpful and makes you and your child’s child care journey stress-free and enjoyable.

How to apply for Child Care Subsidy

Am I eligible for a Child Care Subsidy?

You may be entitled to a Child Care Subsidy if you meet the following criteria:

- You or your partner are either the primary carer of a dependent child or care for the child a minimum of two nights per fortnight.

- You or your partner are responsible for the child care fees.

- The child meets all the immunisation requirements.

- You use an approved child care service.

What are the main factors that affect how much CCS I am entitled to?

How much CCS you are entitled to depend on four main factors:

- Your total combined household or family income.

- Your child care service type, such as outside school hours care (OSHC) or extended day care.

- The number of dependent children you have in your care.

- The work-related activity you undertake fortnightly.

What if I have more than one child in care?

If you have more than one child in care, you may be entitled to a higher subsidy for your second and younger children. Although the eldest child will get the standard rate, younger children may be eligible for a 30-95% higher Child Care Subsidy rate.

To be eligible for the higher subsidy, you must:

- Have more than one child aged 5 or lower within child care.

- Have an annual combined household income of less than $354,305.

You will continue to receive income-tested CCS for all children, although the higher rate CCS-eligible child percentage will have the increase automatically incorporated in the CCS percentage.

At Kynd Montessori, we always ensure you have all the available tools, knowledge and resources.

Our handy guide helps you understand what Child Care Subsidy is, how to apply for it and any other information that may help you and your child on your child care journey.

Disclaimer

Please note: Whilst all information is correct as of 23/11/2022, figures are subject to change. We suggest you conduct further research and seek advice from the correct government organisations, including visiting the Services Australia Website.

How do I check my CCS Eligibility?

Checking your CCS eligibility is the first step you need to do, which can be done on the Service NSW website. Once you have done this, please apply as soon as you know when your child will start day care.

A few questions asked on the NSW Website are:

- Your family’s fortnightly activity hours.

To calculate your family’s fortnightly activity hours and what type of approved fortnightly activity CCS takes into consideration when working out your Child Care Subsidy, you must be engaged in the following:

- Paid work (including leave)

- Self-employed work

- Actively job seeking

- Volunteering

- Working for free (within your family business)

- Studying (must be an approved course)The travel time to and from your child care service to your place of work, study or any other approved activity will also be considered while calculating your rate.

Your fortnightly hours to hours of subsidised child care are as follows:

- Between 8 – 16 hours of fortnightly activity = 36 hours of subsidised child care.

- Between 16 – 48 hours of fortnightly activity = 72 hours of subsidised child care.

- More than 48 hours of fortnightly activity = 100 hours of subsidised child care.

- Kindergarten-aged children = 36 hours of subsidised child care in an approved day care service with no government activity test required.

- Your combined family income.

- Intended amount of day care, early education or child care, including hours, days and times.

- Your combined family income.

- Intended amount of day care, early education or child care, including hours, days and times

All these factors will help your gauge your eligibility before you apply for your CCS. Then, when you find out how much you may be entitled to, it is time to apply.

If you know when your child will start child care or early-year education, apply as soon as possible so that it is all set up for when they start. You do not need to know which child care centre your child will attend.

Starting child care and exploring a world of new experiences should be a fun time for your child, and watching them grow should be a fun experience for you too! Knowing that everything, including finances, is sorted will make the experience more enjoyable.

How do I apply for Child Care Subsidy?

To apply for Child Care Subsidy, you need to follow these five easy steps:

- Sign in to your MyGov Account and go to Centrelink.

- On the Centrelink menu options, select ‘Payment and Claims’ – > ‘Claims’ -> ‘Make a Claim’.

- Select ‘Families’ and click get started!

- Answer all the required questions on the form

- If you have any questions regarding the form, contact the CCS Helpline on 136 150 who can assist you further

- Click submit

You can track the process for your CCS claim online and, alternatively, reach out to the CCS helpline for further assistance. The CCS Helpline is open Monday to Friday from 8 am – 8 pm.

Remember, no question is too silly or too small. If you are worried, do not hesitate to reach out, your child’s education is essential, and so are your concerns.

After applying for your Child Care Subsidy and once your child is enrolled in their child care program with a confirmed starting date, you must confirm and provide your ECE service with the following:

- Your DOB (date of birth)

- Your child’s/children’s DOB

- Your Customer Registration Number (CRN)

You must then confirm the Complying Written Agreement (CWA) on the MyGov Portal. Once your child is enrolled, it must be confirmed on the MyGov portal.

We recommend that you submit your CCS claim and your CWA before your child starts school or child care. Doing so will ensure you receive the benefits as soon as possible and avoid paying the fees.

Confirming your Complying Written Agreement (CWA)

What is a Complying Written Agreement?

The Complying Written Agreement, also known as CWA, is the agreement for families to receive Child Care Subsidy and care in return for fees. The CWA includes information in writing on the arranged agreement and can be made/recorded electronically or on paper, and must always be kept by the provider.

If the CWA includes this information in writing, it can be made through the same enrolment form or process the provider uses to enrol a child.

The agreement can cover one or more children attending the same child care service, although each child must have an individual enrolment number.

What information must the Complying Written Agreement have?

The enrolment notice will reflect the type of arrangement that is in place between you and your provider.

According to the Australian Government Department of Education, the CWA must contain the following information:

- The names and contact details of the provider and the individual(s)

- The date the arrangement starts

- The name and date of birth of the child or children

- If care will be provided on a routine basis and if so, include:

- Details of the days on which sessions of care will usually occur

- The usual start and end times for these sessions

- Whether care will be on a casual or flexible basis (in addition to, or instead of, a routine basis)

- Details of fees charged under the arrangement (providers can reference a fee schedule or information available on their website), which the parties understand may vary from time to time.

- Additional information can be included to support the individual’s understanding of their payment obligations.

How long does it take for my Complying Written Arrangement to be processed?

The Complying Written Arrangement notice may take 24 – 48 hours from when you approve it through Xplor (Child Care Subsidy software) and when Centrelink updates your information.

Once your provider enters a Complying Written Arrangement with you, they must submit an enrolment notice within 7 days from the end of the week of arrangement. Please note that this is nothing for you to worry about but is helpful information so you feel informed on the process from the educational provider’s end.

The next steps after you apply for Child Care Subsidy.

Understanding Your Child Care Subsidy Notice

When your Child Care Subsidy is finalised, the Australian Government will send you your Child Care Subsidy notice via post or online directly to your MyGov inbox. The notice will let you know the following:

- If you are eligible

- How much you are eligible for

- If the child subsidy annual cap applies to you

- The Child Care Subsidy withholding amount

It will also contain the CCS assessment notice table, which includes the following:

- Your child or children’s name/names

- Your subsidy type

- If you’re eligible for Child Care Subsidy, you may also qualify for an Additional Child Care Subsidy.

- Your subsidy percentage

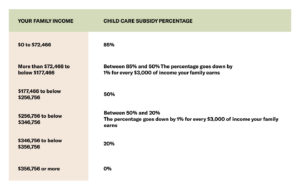

Your Child Care Subsidy percentage is determined based on your family income estimate.

Your Child Care Subsidy percentage applies to the lowest of either:

- The hourly fee you’re charged by your child care service.

- The hourly rate cap.

If your family income is $353,680, or more, your subsidy percentage will likely be zero. However, it is still vital that you submit a claim for the subsidy, as your income may change when your payments are balanced after the end of the financial year. If, after the financial year, your actual family income is calculated (or balanced) at less than $353,680, you will be entitled to the subsidy.

You can visit the Australian Government website for more information on how your family income affects your Child Care Subsidy percentage.

- Your subsidised hours per fortnight

Your child care subsidised hours are worked out based on your activity per fortnight. If you and your partner have less than 8 hours of activity, your subsidised hours will be zero.

You can learn more about this by reading how your activity level affects Child Care Subsidy.

- The annual cap (and whether this applies to you)

The annual Child Care Subsidy cap depends on your family income estimate and applies to each child in care for each financial year. In general, the Child Care Subsidy cap status is assessed depending on the following:

- If your family income estimate is $189,390 or less, there will be no annual cap on your subsidy.

- If your family income ranges between $189,390 – $353,680, your annual cap will be $10,560.

See below how much Child Care Subsidy percentage and cover you can expect on average using your combined annual income.

- Any withholdings

The Government will withhold 5% of your Child Care Subsidy fortnightly to reduce the likelihood of an overpayment and avoid an overpayment debt at the end of the financial year after your payments have been balanced. You can change the Child Care Subsidy amount by calling the CCS family line on 136 150.

Remember: Always update your details to get the most up-to-date Child Care Subsidy fees and rates or to see if you may be entitled to an additional Child Care Subsidy. The easiest way to update your Child Care Subsidy details is with your Centrelink online account through myGov.

Additional Child Care Subsidy & Higher Child Care Subsidy

If you are eligible to receive additional Child Care Subsidy, you can apply for the following:

• Child wellbeing

• Grandparents

• Temporary financial hardship

• Transition to work

Visit the Australian Government Department of Education website for more information on Additional Child Care Subsidy and Higher Care Subsidy and to check your eligibility.

Conclusion

We believe that a parent should be heard, assisted and involved through every step of their child’s education, including any financial worries or concerns throughout their child’s child care journey.

We understand that you must consider all options and ask those all-important questions at such a fun and exciting time. However, to make this possible and form a genuine personal relationship with your child’s potential child care centre, we always encourage parents to visit the centres they are considering. By doing so, parents will better understand the environment and financial options and get the chance to talk to the montessori educators about their Child Care Subsidy or the programs they offer.

We hope our guide has helped you understand Child Care Subsidy and the options or funds available to you. For more information about the Child Care Subsidy annual cap and combined income, we recommend you visit the Australian Government Department of Education Website or give them a call.

For information on the programs we provide and any information within our article, reach out to us by email or phone.

Kynd Montessori – A preschool and early learning centre that’s Kynd by name and kind by nature.

We understand that when it comes to child care and families, it is not one size fits all and that circumstances vary. At Kynd Montessori, we pride ourselves on providing a personalised child care service to suit you and your child, whatever the circumstances.

Child care hours, your working hours and your Child Care Subsidy go hand-in-hand, and we do our best to help you keep your child care costs in check and increase your subsidised hours and pay so your child receives the best education.

We offer transparency regarding our fees so you can calculate your ‘out-of-pocket’ child care payments or fees, your combined annual income, your subsidy percentage, and how it all works.

We are an education community that cares. We are here to discuss your Child Care Subsidy and your situation with non-judgement and care to provide you with all the information you need to be in control.

To book a visit at Kynd Montessori, please use this form, email us at [email protected] or call us directly on 0426 286 676.